6 Secrets to Celebrate the Joys of Being Single

February 10, 2024

College Romance: The Teen’s Guide to Love and Friendship

February 24, 202410 Advantages of Being a Successful POSP Insurance Agent

In today’s fast-paced and uncertain world, the quest for additional income opportunities has become a common pursuit among students and graduates. Whether you’re exploring alternative career options or seeking part-time employment, one avenue that stands out is becoming a Point of Salesperson (POSP) for insurance. This unique opportunity allows individuals to work directly with insurance companies or brokers, selling insurance policies online.

Becoming a POSP Insurance Agent is a great way to do just that. As a POSP Insurance Agent, you can earn a commission on the sale of insurance products. You can also get access to exclusive discounts and offers from insurance companies. Plus, you can use your knowledge and experience to help others make informed decisions about their insurance needs.

So, if you’re a student looking for a way to make some extra money, becoming a POSP Insurance Agent is a smart move. You’ll gain valuable experience in the insurance industry, get access to exclusive discounts and offers, and make a good income from the comfort of your own home.

Requirements to Become a POSP: Opening Doors for Students

The beauty of becoming a POSP lies in its accessibility. As long as you’re over 18 years old and have passed Class 10, you can enrol in a prescribed training program. Successfully clearing the online examinations grants you certification as a POSP, enabling you to sell policies in both life and general insurance categories.

Understanding the Difference: POSP Insurance Agent vs. Insurance Agent

When it comes to navigating the world of insurance, it’s crucial to grasp the nuances between a POSP Insurance Agent (Point of Sales Person) and a traditional insurance agent. While both play vital roles in helping individuals secure coverage, there are distinct characteristics that set them apart. By delving deeper into these disparities, you can make informed decisions that align with your specific insurance needs.

- Products and Profits: While insurance agents can market and sell customizable policies, POSP advisors focus on basic, pre-underwritten insurance products at a transactional level.

- Qualifications and Training: Both require individuals to be at least 18 years old and have a minimum education qualification of a 10th-grade certificate. Training durations differ, with 15 hours for POSP advisors and 25 hours for insurance agents.

- Target Customer Base: POSP advisors cater to clients seeking simple insurance products, while insurance agents target those interested in complex and customized solutions.

- Area of Operation: POSP advisors operate across various geographical areas, including urban, suburban, rural, and metro cities. In contrast, insurance agents focus on larger cities where complex insurance products are in demand.

- Compensation Structure: Both earn through a commission model, with the commission structure varying among insurers.

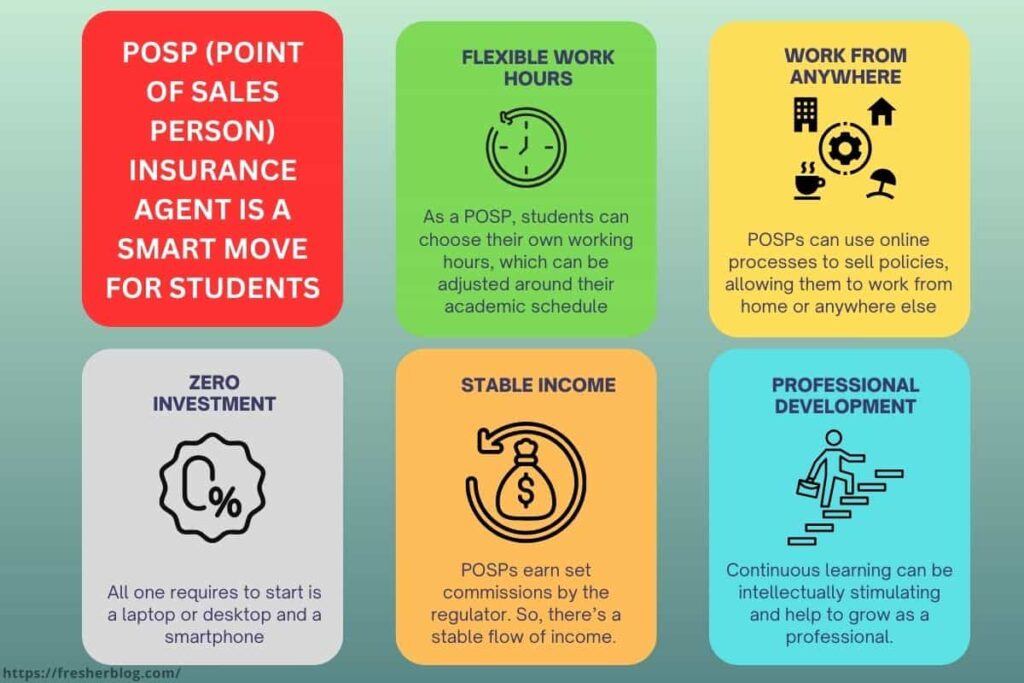

Top 10 Benefits of Being a POSP Insurance Agent

As a student, financial independence is often a coveted milestone. The role of a POSP Insurance Agent opens this gateway, offering not just an income, but a plethora of benefits that contribute to personal and professional growth. Let’s look into the top 10 advantages of stepping into the shoes of a POSP insurance agent, and understand how it can significantly enhance your financial independence

- Ease of Entry: Meeting basic criteria, such as being 18 years old and completing Class 10, opens the door to becoming a POSP. All you need is a smartphone, laptop, and a reliable internet connection.

- Flexible Timings: Forget the conventional 9-5 grind. As a POSP, you can set your own working hours, making it ideal for students, homemakers, and retirees looking for part-time income.

- Work From Home: Embrace the freedom to work from the comfort of your home, thanks to the online processes that facilitate insurance sales without the need for travel.

- Be Your Own Boss: Enjoy the autonomy of working for yourself. Set your schedule, targets, and decide how much time and effort you want to invest in selling insurance policies.

- Stable Income: POSPs earn fixed commissions set by the regulatory body, offering a stable income stream. Building a customer base ensures a steady flow of income through policy renewals.

- High Income Potential: Unlike traditional jobs, your earnings as a POSP aren’t tied to the number of hours worked but to the number of policies sold. The sky’s the limit, offering substantial income potential based on commissions.

- Zero Investment: With no financial investment required, your only investment is time and effort. A smartphone, computer, and a good internet connection are all you need to get started.

- Learning Opportunities: Training programs led by industry experts provide continuous learning and skill development. The increasing awareness of insurance creates ample opportunities in the industry.

- Making a Positive Impact: As a POSP, you contribute to improving people’s lives by helping them secure their health, plan for the future, and protect their families from unforeseen events.

- Awards and Recognition: The chance to earn national and international recognition, such as Asia’s Trusted Life Insurance Agents and Advisors, adds a layer of prestige to your career.

Choosing the Best Company: Your Gateway to Success as a POSP

Selecting the right company is crucial for a successful career as a POSP. Consider factors like the variety of insurance policies offered, direct collaboration with the company, commission structure, online processes, quick commission settlements, and a robust backend support team. Notable companies meeting these criteria include Digit Insurance and others you can discover through diligent research.

Here are the top insurance companies in India that provide the Point of Salespersons (PoSP) option:

- ICICI Direct: ICICI Direct offers a certified POSP Insurance Agent program. They provide online certification in simple steps, professional training on all insurance products, and the flexibility to work from anywhere & anytime.

- Square Insurance: Square Insurance is considered one of the best POSP insurance companies in India. They offer a comprehensive POSP program.

- PBPartners: PBPartners is the leading PoSP platform in India offering unlimited opportunities and a chance to collaborate with insurers at one place.

- Probus Insurance: Probus Insurance offers a program to become a POSP agent. They are known for their comprehensive insurance offerings.

- InsuranceDekho: InsuranceDekho is a leading insurance platform in India that offers a certified POSP Insurance Agent program. They provide online certification in simple 4 steps, professional training on all insurance products, and the flexibility to work from anywhere & anytime.

Becoming a POSP: A Step-by-Step Guide for Aspiring Students

As the quest for financial independence grows among students, the desire to search into the world of insurance sales through the role of a Point of Sales Person (POSP) has also gained ground. How, then, does one navigate the path to becoming a successful POSP? This step-by-step guide is here to equip aspiring students with the necessary information, breaking down the process into manageable stages. Whether you are a newcomer to the field or a student seeking a dependable side hustle, follow along as we guide you through the process of becoming a certified POSP.

- Create an Account: Visit the official website of any insurance company or download the Partners App to create an account, providing the necessary personal details.

- Document Submission: Submit required KYC documents, including Aadhaar Card, PAN Card, and 10th passing certificate.

- Document Verification: The Quality Check Team conducts a thorough document verification process.

- Online Training and Examination: Once verified, initiate the training process, qualify for the exam, obtain certification for various insurance products, and start your journey as a POSP advisor

- Exam Clearance: Clear the exam, and you’ll receive a POSP License, empowering you to sell insurance policies in accordance with POSP guidelines.

Conclusion

Becoming a POSP Insurance Agent is a great way for students to gain valuable experience and financial benefits. It is a flexible job that allows students to work around their studies and other commitments. With the right attitude and dedication, students can make a successful career out of being a POSP Insurance Agent. By following the tips outlined in this article, students can ensure that they are well-prepared to take on the role and make the most of the opportunities it presents. So, if you’re a student looking for a way to make some extra money and gain valuable experience, becoming a POSP Insurance Agent is a smart move.