6 Secrets to Celebrate the Joys of Being Single

February 10, 2024

College Romance: The Teen’s Guide to Love and Friendship

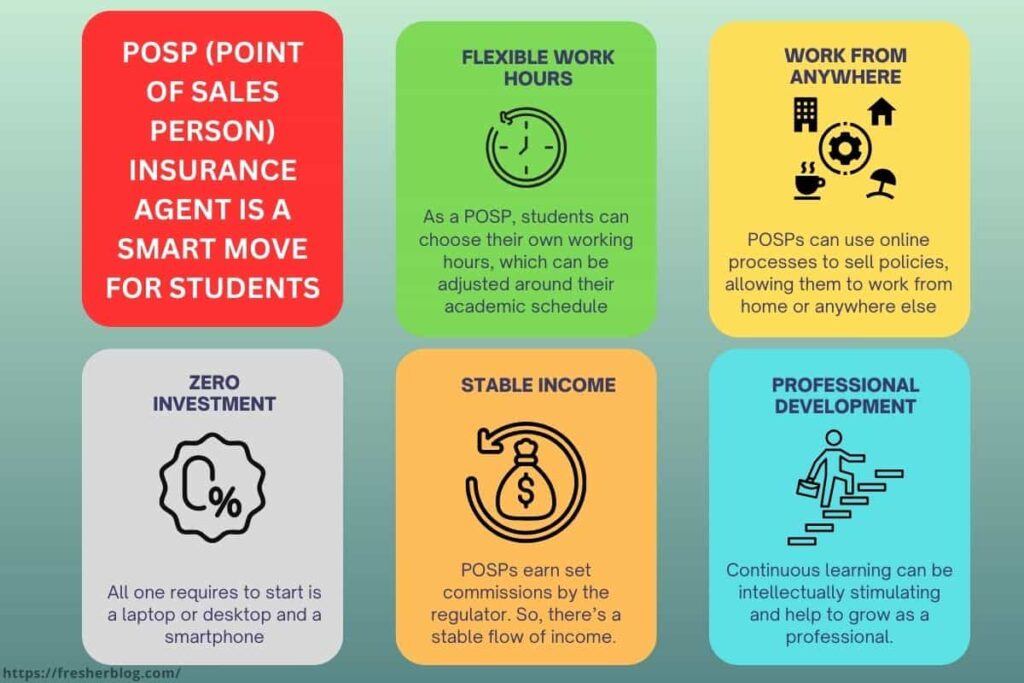

February 24, 2024In today’s fast-paced and uncertain world, the quest for additional income opportunities has become a common pursuit among students and graduates. Whether you’re exploring alternative career options or seeking part-time employment, one avenue that stands out is becoming a POS agent in the insurance industry. This unique opportunity allows individuals to work directly with insurance companies or brokers, selling insurance policies online.

What is a POSP?

Definition and Role in the Insurance Industry

A POSP (Point of Sales Person) is an insurance agent with a unique role in the industry. If you’re looking to enter this field, especially as a beginner or a college student, this could be a perfect fit. As a POSP, you have the opportunity to sell insurance policies directly to consumers, which means you’ll be guiding people through important decisions that impact their financial security.

Your job as a POSP isn’t just about selling policies. It’s about building trust between the customer and the insurance company. You’re the bridge that helps people understand their insurance needs and the options available to them. Whether it’s motor insurance, life insurance, or health insurance, a POSP can sell a variety of products, making the role versatile and dynamic.

Imagine being the go-to person for someone who needs guidance on protecting their health, vehicle, or even their family’s future. That’s the kind of impact a POSP insurance agent can make. It’s not just a career—it’s a chance to help others while building a strong professional future for yourself. If you’re passionate about making a difference and want flexibility in your career, becoming a POSP insurance agent is a great path to explore.

Benefits of Working as a POSP

Working as a POSP insurance agent comes with plenty of rewards, especially if you’re someone looking for flexibility and growth. One of the biggest advantages is the potential to earn a significant income. The more insurance policies you sell, the more you can increase your earnings. It’s all about effort and dedication.

Plus, being a POSP gives you the freedom to work independently. You can set your own schedule, giving you the balance to pursue other interests or studies while still growing in your career. This kind of flexibility is rare, and it’s perfect for students or anyone wanting more control over their time.

Over time, you can build a loyal client base, which opens the door to establishing a successful insurance agency. The relationships you develop with clients can lead to a long-lasting and fulfilling career.

Eligibility and Requirements

Eligibility Criteria for Becoming a POSP

If you’re thinking of becoming a POSP insurance agent, the process is simple and straightforward. First, you must be at least 18 years old to qualify. This makes it an excellent opportunity for young adults or students eager to start building their career early.

The minimum education requirement is completing class 10, so if you’ve cleared this level, you’re already on your way. Beyond that, to register as a POSP, you’ll need some basic documents: a PAN card and proof of address, such as an Aadhaar (UID).

With these requirements, you can begin your journey toward becoming a POSP. It’s an accessible and exciting path for anyone ready to explore the insurance industry and start earning an income on their terms.

Required Documents and Training

To become a POSP insurance agent, you’ll need to have a few key documents ready. You’ll be asked to upload your PAN card, proof of address (such as your Aadhaar), and your 10th or 12th class marksheet. These are essential for registration, so keep them handy.

Next comes the training. The IRDAI requires all aspiring POSP agents to complete a basic 15-hour training program. This is designed to help you understand the insurance products you’ll be selling and the regulations around them. It’s a crucial step in preparing you for success.

Once the training is completed, you’ll need to pass a certification exam. This will officially certify you as a POSP, opening up a world of opportunities in the insurance field. With the right documents, training, and dedication, you can start your journey toward becoming a successful POSP insurance agent.

Career Benefits and Opportunities

Unlimited Earning Potential as a POSP

As a POSP insurance agent, your earning potential is in your hands. With every policy you sell, you move closer to increasing your monthly income, which can go up to ₹85k* or more. It’s a rewarding career, especially if you’re someone who enjoys working independently and setting your own goals.

What makes this even better is that there’s no limit to how much you can earn. The more policies you sell, the higher your earnings. Whether it’s motor, health, or life insurance, each sale brings you closer to achieving your financial goals.

This flexibility is perfect for college students or anyone looking for extra income. You can grow at your own pace while learning valuable skills in the insurance industry. Becoming a POSP insurance agent not only gives you financial freedom but also empowers you to build a career where your hard work truly pays off.

Career Growth and Development

Becoming a POSP insurance agent opens doors to endless growth opportunities. Whether you choose to work part-time or full-time, you have the flexibility to shape your career on your terms. This path allows you to work with different insurance products, from life to health to motor insurance, giving you a well-rounded understanding of the industry.

As you gain experience and build relationships with clients, you’ll find plenty of room for advancement. The more policies you sell, the stronger your reputation becomes, and with that comes even greater opportunities. You can grow your client base, expand your knowledge, and even set up your own insurance business in the future.

For college students or anyone just starting out, the role of a POSP insurance agent is a perfect launchpad. You can build a fulfilling career while gaining valuable skills that will help you succeed in the long run.

Products and Services

Types of Insurance Policies Sold by a POSP

As a POSP agent, you have the opportunity to sell a variety of essential insurance policies. You can offer motor insurance for vehicles, health insurance for individuals and families, and even life insurance to provide long-term security. Whether it’s general insurance to cover accidents or specific life insurance plans, the range is vast.

You’re not limited to just one type of client either. From individuals to families, everyone needs insurance, and as a POSP, you can cater to their needs. This diversity allows you to grow, helping more people while expanding your expertise.

Key Features and Benefits of Each Policy

As a POSP insurance agent, you’ll be offering a range of valuable policies that truly make a difference.

Motor Insurance Policies

These cover vehicles from damages due to accidents, theft, or natural disasters, ensuring drivers have peace of mind on the road.

Life Insurance Policies

Life insurance offers financial protection for families after the policyholder passes away, helping loved ones stay secure.

Health Insurance Policies

Health insurance covers medical expenses, giving people the confidence that their health is protected without the worry of high costs.

Each policy ensures security and peace of mind for your clients.

How to Become a POSP Insurance Agent

Step-by-Step Process to Become a POSP

If you’re considering a career as a POSP insurance agent, you’ve already taken the first step towards a rewarding opportunity. Let me walk you through the simple process.

Meet the Eligibility Criteria

First, ensure you meet the basic eligibility criteria set by the insurance company. Usually, this means being at least 18 years old and having passed 10th grade. You don’t need to worry if you don’t have a financial background—this career is open to all.

Complete the POSP Training Program

Next, sign up for the POSP training program. This is where you’ll learn the ins and outs of insurance. The program isn’t long, but it’s packed with everything you need to succeed. Stay focused, and before you know it, you’ll be ready for the next step.

Pass the Certification Exam

After your training, you’ll need to pass a certification exam. Don’t stress—if you’ve paid attention during training, this should be a breeze. The exam is your key to unlocking a career as a POSP insurance agent.

Register as a POSP

Finally, once you pass the exam, you can register as a POSP with the insurance company. This is your official entry into the world of insurance. From here, you can start selling policies and helping people secure their future.

Becoming a POSP insurance agent is a straightforward process, and you’ve got what it takes to succeed. Now, it’s just about taking the first step and following through.

Registration, Licensing, and Certification

To begin your journey as a POSP insurance agent, you’ll first need to register with the insurance company. This is your official starting point, and it opens the door to an exciting career. Registration is usually a simple process that helps you get recognized as a POSP.

Once registered, you’ll need to obtain a license to sell insurance policies. It’s essential—this is what makes you legitimate in the industry. Don’t worry, the process is straightforward.

Finally, complete the certification program. This step ensures you are fully equipped with the knowledge and skills to excel as a certified POSP insurance agent. You’ve got this! Every step brings you closer to success.

Responsibilities and Expectations

Work Schedule and Flexibility as a POSP

One of the best things about being a POSP insurance agent is the freedom you get with your schedule. You can choose to work full-time if you’re ready to dive in, or part-time if you need flexibility around your studies or other commitments. The choice is entirely yours.

Not only that, but you can also decide where you want to work. Whether it’s from the comfort of your home or in an office, the option is yours. And the best part? You can set your own hours. This career puts you in control of your work-life balance.

Sales Platform and Tools for Success

As a POSP insurance agent, you’re never alone in your journey. You’ll have access to a powerful sales platform, making it easy for you to manage and sell insurance policies. The tools are designed to simplify your work, allowing you to focus on what matters most—helping people.

In addition to these tools, you’ll receive ongoing training and support to ensure you’re always growing and staying on top of your game. Plus, a dedicated supervisor will be there to guide you whenever you need help. With these resources, success is truly within your reach.

Earning Potential and Incentives

Commission Structure and Bonus Schemes

As a POSP insurance agent, your earnings will grow with every policy you sell. For each sale, you’ll earn a commission, which means your income directly reflects your hard work. It’s a fair and rewarding system.

On top of that, you’ll also be eligible for bonus schemes and other incentives. These are designed to keep you motivated and reward your achievements. If you’re dedicated, you can earn more than just a stable income—you’ll have the chance to make a significant financial impact on your life.

With focus and effort, your career as a POSP insurance agent can be both lucrative and fulfilling.

Income Potential and Rewards

As a POSP insurance agent, your income potential is in your hands. The more policies you sell, the higher your earnings will be. It’s a simple equation—your efforts directly shape your success. This gives you the freedom to scale your income based on your goals and dedication.

Performance matters too. You’ll be rewarded for your hard work with bonuses and incentives, adding a boost to your earnings. The opportunity to earn significant income is there, and with focus and determination, you can build a truly rewarding career as a POSP insurance agent.

Overcoming Challenges and Troubleshooting

Common Issues and Solutions for POSPs

As a POSP insurance agent, it’s natural to face challenges while selling insurance policies. Whether it’s overcoming objections from potential clients or understanding complex products, these hurdles can feel daunting. However, don’t worry—you’re not alone in this journey.

You will have access to comprehensive training and support that equips you with the skills needed to tackle these challenges head-on. Additionally, a dedicated supervisor will be available to assist you whenever you need guidance. With the right resources and encouragement, you can navigate these obstacles and thrive in your role as a POSP insurance agent.

Support and Guidance for Success

Embarking on a journey as a POSP insurance agent can be both exciting and challenging. Thankfully, you’re not alone in this endeavor. You will have access to a wealth of support and guidance designed to help you thrive in your new role.

From comprehensive training and development programs to resources tailored for beginners, every step is laid out for your success. Additionally, a dedicated supervisor will be right by your side, ready to assist you with any questions or challenges you face. With this support, you can build confidence and achieve your goals as a successful POSP insurance agent.

POSP Insurance Agent vs. Insurance Agent

When it comes to navigating the world of insurance, it’s crucial to grasp the nuances between a POSP Insurance Agent (Point of Sales Person) and a traditional insurance agent. While both play vital roles in helping individuals secure coverage, there are distinct characteristics that set them apart. By delving deeper into these disparities, you can make informed decisions that align with your specific insurance needs.

Products and Profits

While insurance agents can market and sell customizable policies, POSP advisors focus on basic, pre-underwritten insurance products at a transactional level.

Qualifications and Training

Both require individuals to be at least 18 years old and have a minimum education qualification of a 10th-grade certificate. Training durations differ, with 15 hours for POSP advisors and 25 hours for insurance agents.

Target Customer Base

POSP advisors cater to clients seeking simple insurance products, while insurance agents target those interested in complex and customized solutions.

Area of Operation

POSP advisors operate across various geographical areas, including urban, suburban, rural, and metro cities. In contrast, insurance agents focus on larger cities where complex insurance products are in demand.

Compensation Structure

Both earn through a commission model, with the commission structure varying among insurers.

Success Stories and Testimonials

Real-Life Examples of Successful POSPs

Meet Rohan, a successful POSP who has been working with Bajaj Allianz for over five years. Rohan started his career as a part-time POSP while studying and eventually transitioned to a full-time role. He has consistently exceeded his sales targets and has been recognized as one of the top-performing POSPs in his region. Rohan attributes his success to the comprehensive training program provided by Bajaj Allianz and the unwavering support of his mentor.

Another inspiring example is Priya, a POSP who has been working with ICICI Lombard for over three years. Priya began her journey as a POSP with no prior experience in the insurance industry. However, with the help of ICICI Lombard’s training program and her own hard work, she has become one of the top-selling POSPs in her region. Priya’s success story is a testament to the fact that with the right training and support, anyone can become a successful POSP.

Insights and Advice from Experienced POSPs

I spoke to several experienced POSPs to gather their insights and advice on how to become a successful POSP. Here are some key takeaways:

“The key to success as a POSP is to build strong relationships with your clients and provide them with personalized service,” says Rohan from Bengaluru.

“It’s essential to stay up-to-date with the latest insurance products and trends to provide the best possible solutions to your clients,” advises Priya a commerce student from Chennai.

“As a POSP, you need to be proactive and take the initiative to reach out to potential clients and build your network,” says another experienced POSP from Kerala.

Conclusion

Becoming a POSP Insurance Agent is a great way for students to gain valuable experience and financial benefits. It is a flexible job that allows students to work around their studies and other commitments. With the right attitude and dedication, students can make a successful career out of being a POSP Insurance Agent. By following the tips outlined in this article, students can ensure that they are well-prepared to take on the role and make the most of the opportunities it presents. So, if you’re a student looking for a way to make some extra money and gain valuable experience, becoming a POSP Insurance Agent is a smart move.

Summary of Key Points and Takeaways

To become a successful POSP, it’s essential to:

Build strong relationships with your clients and provide them with personalized service.

Stay up-to-date with the latest insurance products and trends.

Be proactive and take the initiative to reach out to potential clients and build your network.

Take advantage of the comprehensive training program provided by your insurance company.

Seek guidance and support from experienced mentors and colleagues.

Final Thoughts on Becoming a Successful POSP Insurance Agent

Becoming a successful POSP insurance agent requires hard work, dedication, and a passion for helping others. With the right training, support, and mindset, anyone can become a successful POSP and build a rewarding career in the insurance industry. Remember to stay focused, stay motivated, and always put your clients’ needs first. Good luck!