How to Build a Strong LinkedIn Profile as a College Student

April 14, 2023

How To Use Online Textbook Rentals to Save Money

June 26, 202310 Awesome Ways How to Save Money as a Student Now

The college offers countless opportunities, but it can also be a period of significant expenses. Saving money as a student in India might seem challenging due to the costs of tuition, books, and living expenses. Now at this stage, you might be wondering how to save money as a student while pursuing your higher education. In this article, we’ll share useful tips that will help you stay on top of your finances. By following these suggestions, you’ll not only enjoy your college experience but also remain within your budget!

1. Budgeting and Financial Management

When it comes to learning how to save money as a student, the first step is understanding where your money is actually going. Trust me, it’s easy to lose track of small purchases here and there, but those add up quickly! Start by tracking every bit of income you receive and every expense you make. Whether it’s buying textbooks, grabbing a coffee, or paying for rent, jot it all down.

Once you have a clear picture, it’s time to create a budget that works for you. A good rule of thumb is the 50/30/20 rule: allocate 50% of your money to necessities like rent, food, and transportation; 30% can go towards discretionary spending, like that concert you’ve been eyeing or a night out with friends; and finally, 20% should be reserved for savings and paying off any debts you might have.

It might seem strict at first, but adjusting your budget regularly will make it easier to stay on track with your financial goals. Don’t forget to review and tweak your budget as needed—your financial health will thank you in the long run!

2. Smart Spending Habits

Avoid Impulse Purchases

One of the quickest ways to drain your bank account is through impulse purchases. We’ve all been there, you’re walking through the store or scrolling online, and suddenly, something catches your eye. Before you know it, you’re swiping your card or clicking “buy now.” But here’s the thing: those spur-of-the-moment decisions can add up, especially when you’re on a tight student budget. It’s important to be mindful of your spending habits and resist the urge to buy things on a whim, particularly when it comes to big-ticket items.

A great way to curb impulse spending is by using the 30-day rule. If you see something you want but don’t necessarily need, wait 30 days before purchasing it. Often, you’ll find that the initial excitement fades, and you might even forget about it altogether. Also, try using cash instead of credit cards. It’s a lot easier to stick to your budget when you physically see the money leaving your wallet. Another tip? Implement a “one in, one out” policy. For every new item you buy, get rid of something you no longer use. This not only helps prevent clutter but also makes you think twice before buying something new.

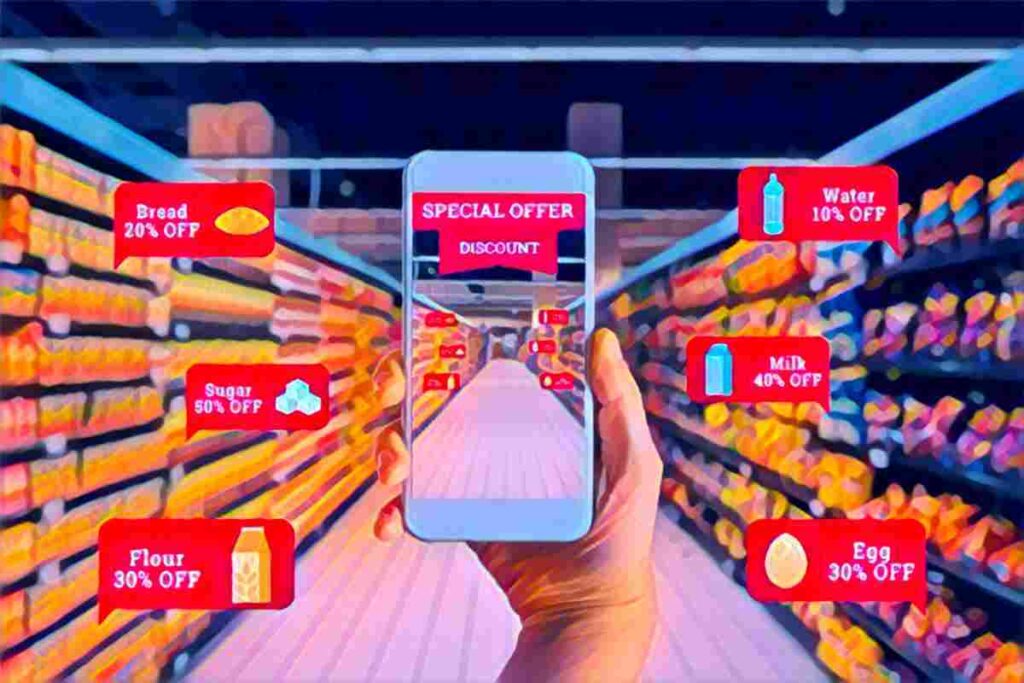

Use Technology to Save Money

In today’s digital age, learning how to save money as a student is easier than ever, thanks to technology. There are so many tools at your fingertips that can help you stretch your budget further. For starters, cashback apps and rewards programs are a must. When you’re shopping for groceries or grabbing a bite to eat, these apps offer rewards that add up over time, giving you a little extra back on purchases you were already planning to make.

Price comparison tools are also a lifesaver. Before buying anything online, take a moment to check if you’re getting the best deal. You’d be surprised how much you can save just by doing a quick search. And while you’re at it, don’t forget to look for online coupons and promo codes—those discounts can make a big difference, especially on larger purchases.

These apps help you track your spending and keep an eye on your savings, ensuring you stay on top of your goals. Finally, consider using a savings app that automatically sets aside a little money each week or month.

3. Saving on Everyday Expenses

Cook Your Own Meals

One of the simplest and most effective ways to save money as a student is by cooking your own meals. Not only does this help you keep more cash in your pocket, but it also gives you control over what you’re eating, making it easier to stay healthy. Start by planning your meals for the week and making a grocery list. This way, you’ll avoid buying unnecessary items and wasting food. Trust me, a little bit of planning goes a long way!

If you want to save even more time and money, consider meal prepping or cooking in bulk. By making larger portions, you can have ready-to-eat meals for the week, which means less temptation to grab fast food or order takeout.

While it can be tempting to eat out with friends, cooking at home is almost always the cheaper option. Plus, it’s a great way to experiment with new recipes and develop your cooking skills.

Use Public Transportation

One of the smartest tips on how to save money as a student is by using public transportation. The costs of fuel, parking, and car maintenance can quickly add up, so opting for the bus, train, or metro can be a real money-saver. If you’re commuting regularly, consider buying a monthly pass. It’s usually much cheaper than paying per ride, and it makes budgeting a breeze.

Another option is to use ride-sharing services, especially if public transport isn’t always convenient. You can split the cost with friends, which not only saves money but also makes the journey more enjoyable. Don’t forget to plan your routes using online resources. This can help you avoid traffic and delays, saving you time as well as money.

If you’re looking to save even more, consider carpooling or biking to school. Carpooling reduces costs by sharing them with others, while biking is not only free but also a great way to stay fit.

4. Taking Advantage of Student Discounts

Exploit Student Discounts

One of the best-kept secrets to saving money as a student is taking full advantage of student discounts. With just a flash of your student ID, you can unlock savings on everyday essentials like food, clothing, and entertainment. Many stores, restaurants, and service providers offer special discounts exclusively for students, so don’t be shy, ask if they have any student deals available.

You might be surprised at how much you can save on things you buy regularly. And when it comes to big-ticket items like laptops and software, student discounts can make a significant difference. Many tech companies and software providers offer reduced prices for students, so take advantage of these offers before making a purchase.

Keep an eye out for student-specific promotions and sales, too. Brands often run special campaigns just for students, giving you even more opportunities to save. allowing you to focus more on your studies and less on financial stress.

5. Saving on Education Expenses

Buy Second-Hand Products

When it comes to saving money on education expenses, buying second-hand products is a smart move. Textbooks, laptops, and other educational materials can be costly, but you don’t have to buy everything brand new. Instead, explore online marketplaces or campus resources where students often sell their used items at a fraction of the cost. You’d be surprised at the quality you can find!

Another great option is to rent textbooks or share them with classmates. Not only does this reduce costs, but it also encourages collaboration and sharing of knowledge. Many online platforms offer textbook rentals, so you can use what you need without the full price tag. And don’t forget about digital resources. Many textbooks are available in digital format, often at a lower cost than physical copies. Plus, digital materials are more convenient and easier to carry around.

Lastly, keep an eye out for discounts and promotions on educational materials. Sometimes, you can score big savings on essential items by timing your purchases right. By opting for second-hand and digital resources, you can keep your education expenses low and focus on what truly matters—your learning and growth.

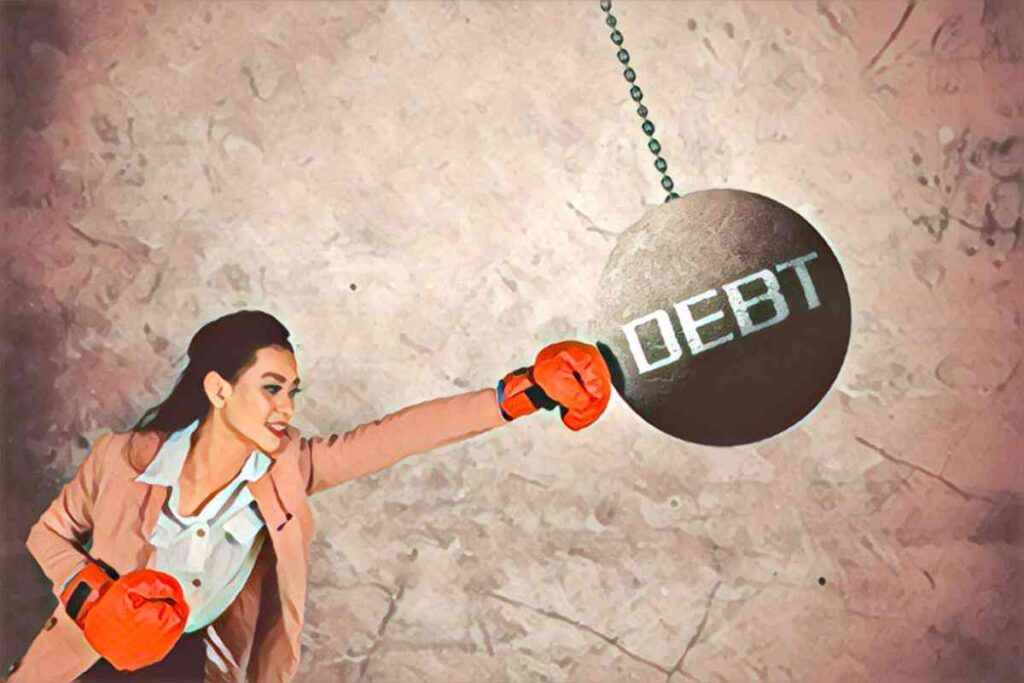

6. Managing Debt and Credit

Deal with Debt as Early as Possible

Debt can feel like a heavy burden, especially as a student trying to manage expenses. But tackling it head-on is one of the best ways to save money in the long run. Start by making a plan to pay off high-interest debt, like education loans, and credit card balances, as soon as possible. The faster you can eliminate these high-interest debts, the more you’ll save on interest payments.

If your debts feel overwhelming, consider consolidating them into a lower-interest loan or credit card. This can simplify your payments and reduce the amount you pay in interest over time. Another effective strategy is the snowball method, where you focus on paying off your smallest debts first. This approach helps build momentum and gives you a sense of accomplishment as each debt disappears.

While you’re working on paying off existing debt, avoid taking on new debt. It’s easy to get caught in a cycle of borrowing, but staying disciplined now will pay off in the future. Seeing your debt shrink can be incredibly motivating and help you stay focused on your goal. Managing debt wisely is key to financial freedom as a student.

7. Finding Free or Low-Cost Entertainment

Find Free Entertainment Sources

Saving money as a student doesn’t mean you have to miss out on fun. There are plenty of ways to enjoy yourself without breaking the bank. Start by exploring free or low-cost entertainment options around you. Campus events, parks, and museums often offer activities that won’t cost you a dime. These are great places to unwind and socialize without spending much.

Online resources can be a goldmine for finding free or discounted events and activities. Whether it’s a local concert, a community event, or a special discount day, a little bit of research can go a long way.

You can also bring the fun home by hosting your own events. Organize a game night or movie marathon with friends. It’s a fun way to bond without the high costs of going out.

And don’t forget about streaming services and public libraries. They offer access to tons of free or affordable entertainment. Finally, always keep an eye out for student discounts on entertainment like movie tickets and concerts. These small savings can add up, helping you stretch your budget while still enjoying the things you love.

8.Saving on Travel

Reduce Your Travel Costs

Travelling as a student can be expensive, but with a little planning, you can save a significant amount of money. Start by planning your trips well in advance. Booking transportation and accommodations early often gives you access to better deals and discounts.

Using online resources is another great way to find travel bargains. Websites and apps dedicated to student travel often offer exclusive discounts on flights, hotels, and even activities. It’s worth exploring these options before finalizing your plans.

And if you’re using a travel rewards credit card, make sure to take advantage of the points and perks. These can add up quickly and give you substantial savings on future trips. By being mindful of how you travel, you can explore the world without emptying your wallet.

9. Using Student-Specific Services

Open a Student Bank Account to Save Money as a Student

Opening a student bank account is a savvy move to manage your finances and save money while in school. Many banks offer accounts designed specifically for students, featuring low fees and perks like higher interest rates on savings. Look for options that cater to student needs and provide benefits like no minimum balance requirements.

Online and mobile banking apps are essential tools for staying on top of your finances. These apps let you track your spending, set budgets, and manage your money efficiently, all from your smartphone. They also make it easier to avoid fees and keep your account in good standing.

A student credit card can be another helpful financial tool. It not only helps you build credit but can also offer rewards and cashback on everyday purchases. Just be sure to use it responsibly to avoid debt.

Additionally, don’t forget to explore student-specific financial resources like scholarships and financial aid. These can provide valuable savings and reduce your overall expenses.

10. Seeking Financial Advice and Support

Free Money Advice and Support

Tapping into the free financial advice and support available on campus can be another great option to look out for. Financial aid offices and counselling services are there to help you manage your money, understand your financial aid options, and find resources tailored to students like scholarships and grants.

Online resources can also be a goldmine for financial advice. Websites dedicated to student finances offer tips, budgeting tools, and guides to help you make informed decisions. You can check this website’s personal finance section to know more.

If you need more personalized help, consider filling out the contact form on this website. I often work with a group of financial advisors, and we can offer tailored advice on budgeting, saving, and planning for the future. And this is absolutely free for you.

Additionally, participating in financial literacy programs can provide valuable insights into managing your finances. These programs teach essential skills like budgeting, saving, and investing, which are crucial for long-term financial health.

Conclusion

The strategies outlined in this article provide college students with the opportunity to save money while enjoying their studies. From living at home and utilizing public transportation, investing in a quality laptop, or starting a side hustle – there are plenty of options available for those looking to stretch their budget. With these tips as your guide, you can feel confident that you’ll be able to manage your finances effectively throughout your college years. So, make sure you take advantage of all the resources available and start saving money today!

1 Comment

good