Body Image Issues in Teens: Everything You Need to Know

December 2, 2023

Hate Your Tattoo? Here’s How to Conceal It Flawlessly

December 16, 2023The Beautiful Truth About the Best P2P Lending Platform In India

The first place we think of when we need a loan is a bank. But what is P2P lending? It is a direct connection between borrowers and lenders through online platforms, offering easier access to funds for borrowers, potentially lower interest rates, and attractive returns for lenders. P2P lending is a fascinating phenomenon that has emerged recently. You can genuinely borrow money straight from other people or even lend out your cash to others in place of borrowing from a bank. It is completely done online and is very well-liked right now.

According to projections, the global P2P lending market could be valued at an astounding $567.3 billion by 2027! There are currently more than 40 active P2P platforms in India, and each year, they disburse loans totalling enormous sums of money.

The most wonderful thing is that it supports ordinary individuals like you and me as well as small enterprises who might find it difficult to obtain bank loans. They can now easily obtain the funds they require thanks to peer-to-peer lending.

Furthermore, it involves more than just obtaining loans—it also involves our overall money management practices. These peer-to-peer (P2P) networks prioritize transparency, competitive interest rates, and ease of usage. To help you decide where to spend your money wisely if you wish to become a lender, we will go into further detail about the features and benefits of the top P2P lending platforms in India in this post. This article will also explore the particulars and advantages of the best P2P lending platform in India, helping you decide on the best investment platform.

What Is Peer-to-Peer (P2P) Lending?

Have you ever found yourself in a scenario where you need some additional cash but do not want to deal with the hassles of regular banking? Well, let me introduce you to the world of peer-to-peer lending, also known as P2P lending.

P2P lending allows you to borrow money directly from other people, eliminating intermediaries and complex processes. It is like having a network of friends ready to help you when you need it the most. And the best part? There are online platforms that make the process simple for anyone with an internet connection.

Now, I know what you are thinking: “But where can I find these platforms in India?” Well, I did the research and have the inside knowledge on the best P2P lending platforms in India.

Definition and Benefits of P2P Lending

P2P lending, also known as peer-to-peer lending, is a financial innovation that enables individuals to borrow and lend money directly, bypassing traditional financial institutions. This model has gained popularity in India due to its numerous benefits.

One of the primary advantages is increased accessibility. P2P lending platforms provide an opportunity for individuals with limited access to traditional credit channels to borrow money. This is particularly beneficial for students and small business owners who might struggle to secure loans from conventional banks.

Another significant benefit is the competitive interest rates. Borrowers can often secure lower interest rates compared to traditional lending options, while lenders can earn higher returns on their investments. This win-win situation makes P2P lending an attractive option for both parties.

Moreover, P2P lending platforms offer diversified investment opportunities. Lenders can choose from a range of loan options, allowing them to spread their investments and manage risk effectively. This diversification is crucial in minimizing potential losses and maximizing returns.

Lastly, the convenience of P2P lending cannot be overstated. Online platforms make it easy for borrowers and lenders to connect and manage transactions. With just a few clicks, you can apply for a loan or start investing, making the entire process hassle-free and efficient.

How P2P Lending Works?

If you are interested in peer-to-peer lending, let me explain to you how it works step by step.

Borrower Application: The procedure begins with a borrower submitting an online loan request on a peer-to-peer lending platform.

Risk Assessment and Credit Rating: After reviewing the application, the platform evaluates the applicant’s risk and credit rating. Based on this evaluation, the platform has set an interest rate.

Interest Rate Assignment: Borrowers are notified of the interest rate and can select whether to proceed or not.

Investor Options: Once authorized, the borrower will receive loan options from lenders. These choices are frequently based on the borrower’s credit score and the interest rate allotted to them.

Options Evaluation: The borrower then reviews and evaluates the lender’s offered loan options. This stage allows them to select the solution that best meets their budget requirements.

Repayment Responsibility: After picking an option, the borrower is accountable for monthly interest payments together with a payback of the principal amount on or before the maturity date.

From the perspective of a borrower, peer-to-peer lending involves a clear step-by-step process that allows them to make an informed decision about borrowing from the appropriate partner.

Registration and Investment Process

Investing in P2P lending platforms in India is a straightforward process. Here’s a step-by-step guide to get you started:

Register: Begin by creating an account on a P2P lending platform. You will need to provide necessary documentation and personal information to set up your profile.

Verify: Complete the verification process, which typically includes KYC (Know Your Customer) checks. This step ensures that your identity is authenticated and that you comply with regulatory requirements.

Deposit funds: Once your account is verified, deposit money into the platform. These funds will be used to finance loans to borrowers.

Choose loans: Browse through the available loan options and select those that align with your investment criteria. Factors to consider include the borrower’s creditworthiness, interest rate, and loan term.

Monitor and manage: After investing, you can track the performance of your loans and manage your investments through the platform’s dashboard. This allows you to stay informed about repayments and returns.

By following these steps, you can start investing in P2P lending platforms in India and potentially earn attractive returns on your investments.

Loan Origination and Repayment

P2P lending platforms handle the entire loan origination and repayment process, ensuring a smooth experience for both borrowers and lenders. Here’s how it works:

Loan application: Borrowers begin by applying for loans on the platform, providing necessary documentation and information about their financial situation.

Credit assessment: The platform then assesses the borrower’s creditworthiness using various criteria. This assessment helps determine the interest rate and loan terms that will be offered to the borrower.

Loan disbursal: Once the loan is approved, the funds are disbursed to the borrower. Lenders who have invested in the loan will start receiving regular interest payments.

Repayment: Borrowers are responsible for repaying the loan according to the agreed-upon terms. As they make repayments, lenders receive their principal investment back along with the interest earned.

This structured process ensures that both borrowers and lenders have a clear understanding of their responsibilities and can manage their financial transactions effectively.

How Is P2P Lending Regulated in India?

In India, the Reserve Bank of India (RBI) regulates P2P lending platforms with detailed guidelines available on their website. You can go through them at RBI Notification related to P2P lending for a better understanding. Companies with NBFC-P2P licenses are only allowed to operate as P2P lenders in India. The involvement of RBI ensures system stability and has a Business Continuity Plan for platforms protecting lenders and borrowers. While P2P lending involves risk just like any other financial instrument. If you are interested, do your research in detail, and choose the best P2P lending platform in India for a higher chance of success.

5 Best P2P Lending Platforms in India

LenDenClub:

The first one on my list is LenDenClub. It is indeed one of the best P2P lending platforms in India. With over 91 lakh trusted customers and more than ₹12,000 crore invested to date, it is clear that LenDenClub has significantly impacted the P2P lending space. Moreover, they offer secure P2P lending solutions, connecting borrowers and investors seamlessly. The platform is designed to provide hassle-free loans and P2P investments. It is also worth noting that they offer attractive returns, with FMPP investors having earned up to 12% p.a. since launch. So, if you are looking to start your investment journey with as low as ₹10,000, LenDenClub could be an excellent choice.

i-Lend:

i-Lend, registered with RBI as an NBFC-P2P, is considered one of India’s best P2P lending platforms. It is an online marketplace that connects people who need money with those willing to lend. The platform allows individuals to borrow and lend money directly to each other, benefiting from a financially rewarding transaction for both parties. As a lender, you can boost your savings by lending money to real people through i-Lend and earn up to 24% returns. You can lend as low as ₹10,000 at comfortable rates. As a borrower, you can get small personal loans through i-Lend with low interest rates starting at 12%. You can choose from an exhaustive list of lenders at rates you are happy to pay! Whether you are a lender looking for a good return on your investment or a borrower needing a low-cost loan, i-Lend has got you covered.

i2iFunding:

i2iFunding, a Reserve Bank of India (RBI) registered Non-Banking Financial Company – Peer to Peer Lending Platform (NBFC-P2P), is recognized as one of India’s best P2P lending platforms. It allows you to grow your money and earn high returns on investment with diversification. With i2iFunding, you can lend money to retail borrowers at attractive interest rates. The platform ensures that only creditworthy borrowers reach you through a sound and automated Credit Evaluation Model. This model uses thousands of data points to evaluate borrowers’ profiles on more than 100 parameters. Less than 5% of total loan applications reach the funding stage on the platform, ensuring the quality of borrowers. i2iFunding also offers a transparent fee structure with no hidden costs. Whether you are an investor looking for high returns or a borrower seeking a low-cost loan, i2iFunding has covered you.

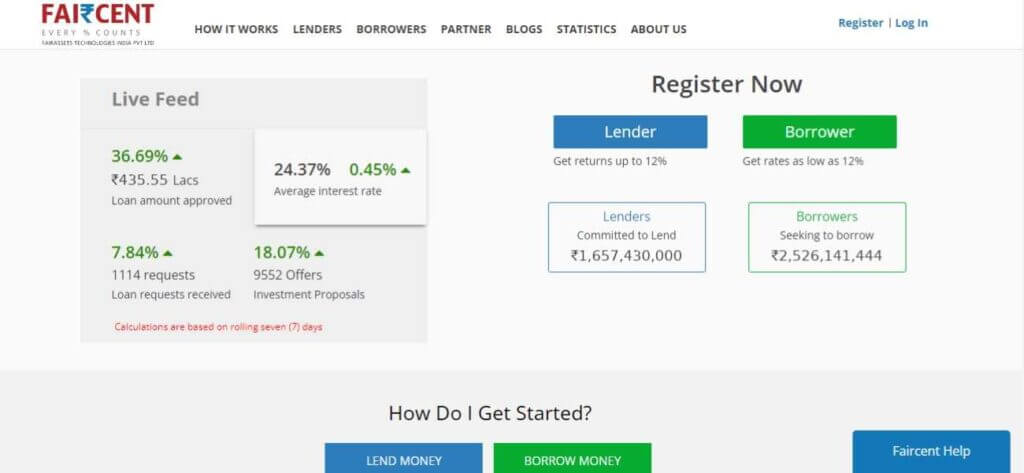

Faircent:

Faircent, the first peer-to-peer (P2P) lending platform in India to receive a Certificate of Registration (CoR) as an NBFC-P2P from the Reserve Bank of India (RBI), is widely recognized as one of the best P2P lending platforms in the country. It is a marketplace that connects individuals needing credit with those willing to lend their excess funds. By using technology to speed up the process and cut costs, Faircent allows borrowers to get their requirements funded at viable rates while helping lenders get the best possible return on their investment. The platform encourages lenders to build a diversified portfolio by spreading their investments across various loans and loan products at different interest rates. Faircent also has mechanisms to manage risk and facilitate collection in case of non-payment of EMIs. So, whether you are a borrower looking for a fair and open marketplace or a lender seeking a good return on your investment, Faircent has got you covered.

Mobikwik Xtra:

MobiKwik Xtra, facilitated by Lendbox, an RBI-regulated peer-to-peer investing platform, is considered another one of India’s best P2P lending platforms. It offers an investment opportunity to earn up to 12% p.a. by lending directly to creditworthy borrowers. The platform ensures that your funds are split into small chunks and distributed among many borrowers, helping to mitigate risk and diversify investments. MobiKwik Xtra and Lendbox work together to ensure that every borrower you lend is thoroughly checked and assessed. If a borrower defaults, they will not earn any income until they return your indicated returns. Your money is routed directly through an escrow bank account managed by an independent trustee and can only be used to lend to borrowers. While there is no guarantee of a 12% per annum return, Lendbox’s risk analysis has shown that this figure is probable due to the minimal risk of default from their creditworthy borrowers.

Factors to Consider Before Investing in P2P Lending

Before diving into P2P lending, it’s crucial to consider several factors to ensure a successful investment experience:

Risk assessment: Understand the risks associated with P2P lending, including credit risk and liquidity risk. Assessing these risks will help you make informed decisions and protect your investments.

Diversification: Diversify your investments across multiple loans and platforms to manage risk effectively. Spreading your investments reduces the impact of any single loan defaulting.

Regulatory compliance: Ensure the platform is registered with the Reserve Bank of India (RBI) and complies with all regulatory requirements. This adds a layer of security and trust to your investments.

Fees and charges: Be aware of the fees and charges associated with the platform, including interest rates and service fees. Understanding these costs will help you calculate your net returns accurately.

Reputation and credibility: Research the platform’s reputation and credibility by reading reviews and ratings from other users. A well-regarded platform is more likely to provide a reliable and secure investment experience.

By considering these factors, you can make informed decisions and choose the best P2P lending platform in India that aligns with your financial goals.

How safe is money in the P2P platform in India?

As previously stated, P2P lending has its own set of risks that you should be aware of. For starters, if a borrower defaults on a payment, all of these platforms will not refund your money or pursue it through credit bureaus, so it is not advisable to rely solely on CIBIL scores. One tip is to consider factors such as the borrower’s job and age and keep in mind that platform verification of bank statements is not guaranteed. Keep an eye out for NPAs, as they can have an impact on the platform’s success.

The Advantages of P2P Lending

When it comes to P2P lending, the following are its advantages: –

Diversity Investments: P2P lending platforms offer an opportunity to diversify your investments. If you can spread your investments into various loans, the risk gets lower.

Attractive Returns: P2P lending platforms offer extremely attractive interest rates for investors. You may even achieve your financial goals with these higher returns.

Accessibility and Convenience: P2P lending platforms are easy to operate and are very user-friendly, with little knowledge of computers and the internet you can start using them.

Credit Opportunities: From the borrower’s perspective, P2P lending platforms offer alternative sources of credit even with a limited credit history or lower credit scores.

P2P Lending vs. Traditional Banking

Now, let us talk about some remarkable differences between P2P lending and traditional lending: –

Flexibility: Traditional banks have strict lending criteria whereas P2P lending is more flexible. Borrowers can source money for various purposes from insignificant amounts to huge investments.

Lower Interest Rates: P2P lending can offer borrowers lower interest rates, especially for those with good credit scores. The competitive nature of different P2P lending platforms often leads to better interest rates.

Direct Interaction: There is a direct interaction between the lender and borrower in P2P lending platforms allowing personalization of borrowing and other arrangements. This can be utilized while negotiating and forming the terms and conditions.

Risk: Indeed, P2P lending is riskier than traditional banking, as there is no guarantee that borrowers will repay their loans. If not properly checked, it can amount to huge losses for lenders.

Regulation: P2P lending platforms are not as heavily regulated as traditional banking, which can make it riskier.

Lack of liquidity: P2P lending platforms are rigid in terms of liquidating your investments. This can be a problem in case you need money for some emergency purpose.

Conclusion

Peer-to-peer (P2P) lending is a growing financial innovation that can disrupt traditional lending. With easy access, potential for high returns, and its unique features, it is very popular for investors and borrowers for unconventional borrowing. As an individual, understanding the process and risks will help you to make informed decisions and often reduce the risk associated with them.

Before opting for this financial instrument, do your research, assess risk tolerance, and choose the best P2P lending platform in India to align with your goals. The sole purpose of this article is to introduce readers to the best lending platforms in India and you need to explore this instrument further.

Good luck on your financial journey!

Disclaimer: The information in this article is for informational purposes only and not financial advice. Readers should conduct their research, consider their financial situation, and consult a professional financial advisor before making investment decisions. The author is not responsible for any decisions made based on this guide’s content.